bank of england base rate

The base rate is used by the Bank to charge other banks and lenders when they borrow money and influences what borrowers pay and savers earn. In.

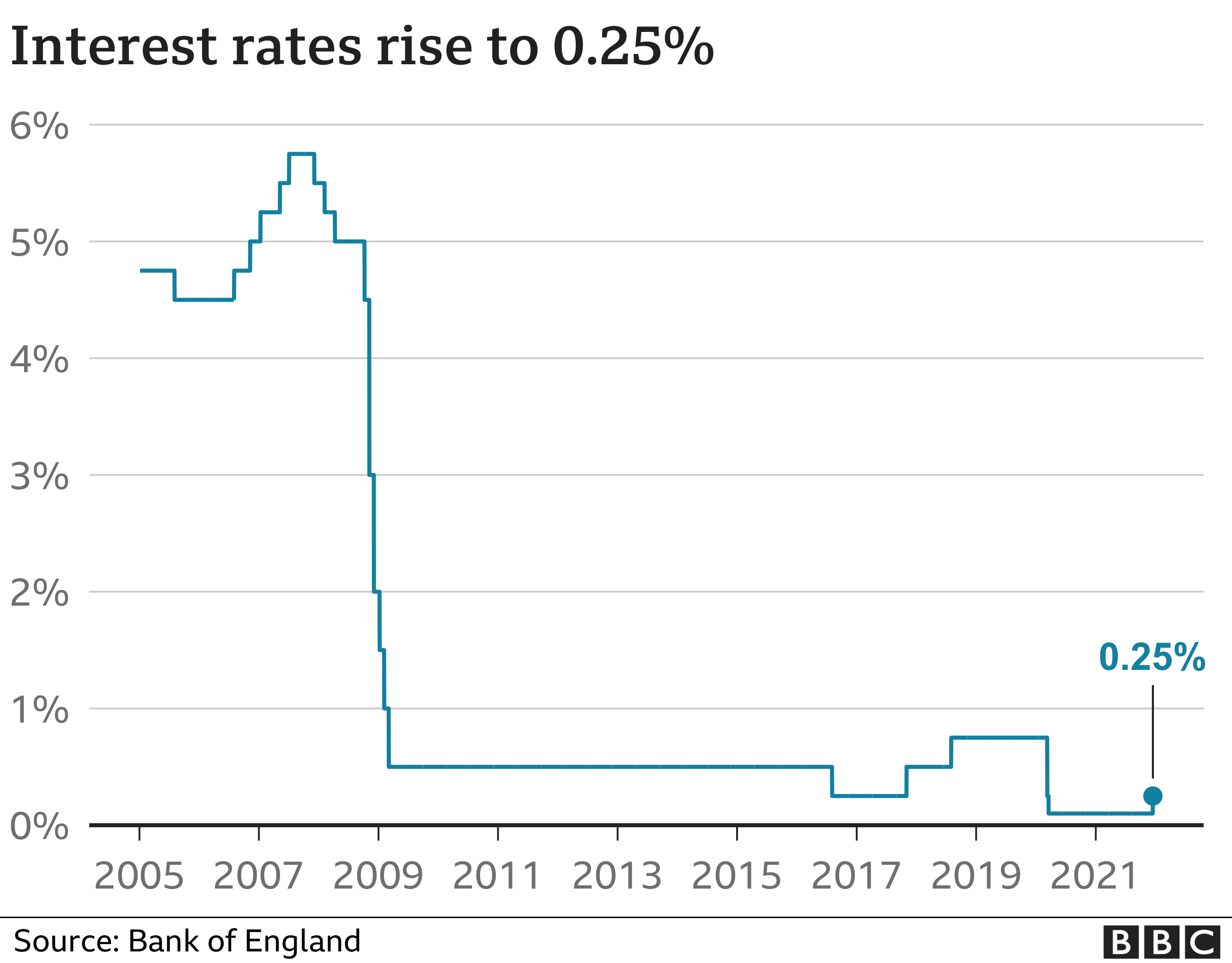

Interest Rates Rise For First Time In Three Years Bbc News

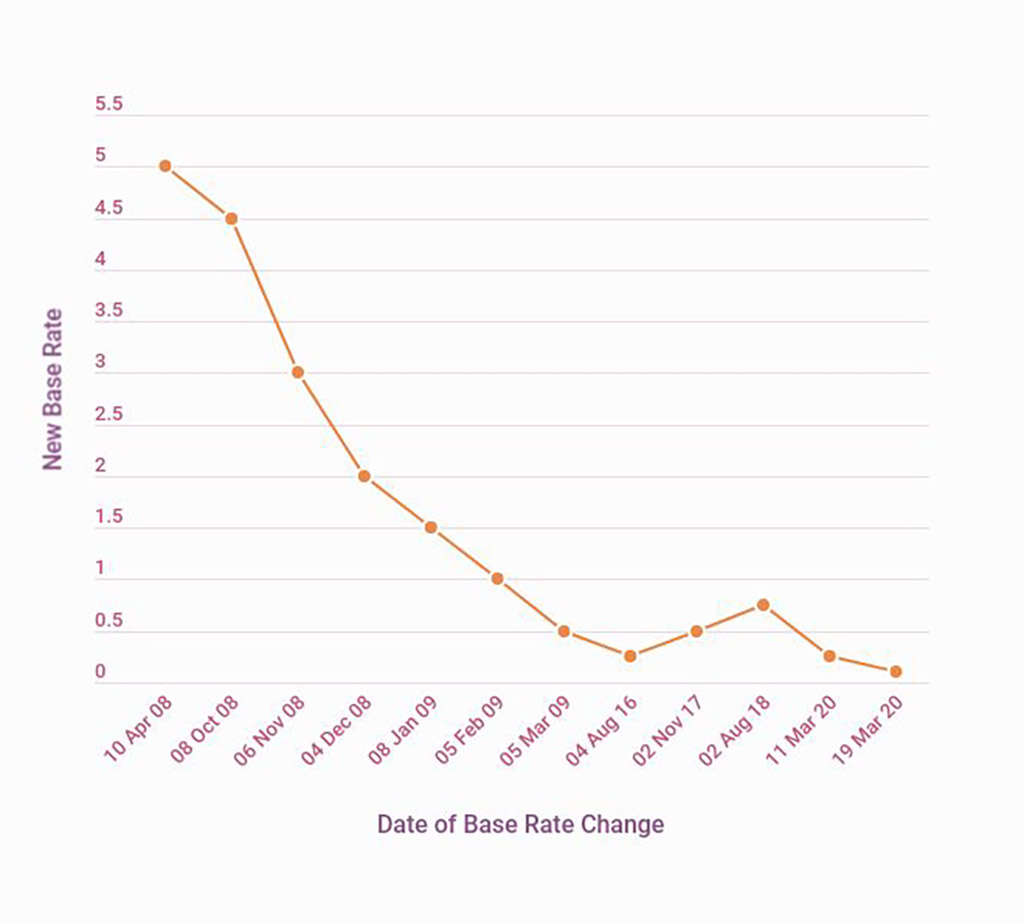

The Bank of England upped the base rate to 025 in December but since then only a handful of savers have felt the benefit The recent unexpected rise in interest rates could have been the good.

. Its part of the Monetary Policy action we take to meet the target that the Government sets us to keep inflation low and. This page shows the current and historic values of. The Financial Stability Report sets out our Financial Policy Committees view on the stability of the UK financial system and what it is doing to remove or reduce any risks to it.

This base rate is also referred to as the bank rate or Bank of England base. The MPC made the decision in response to CPI inflation rising to 51 earlier this week a figure well above the Banks target of 2. Banking and savings solutions for life abroad and international lifestyle needs.

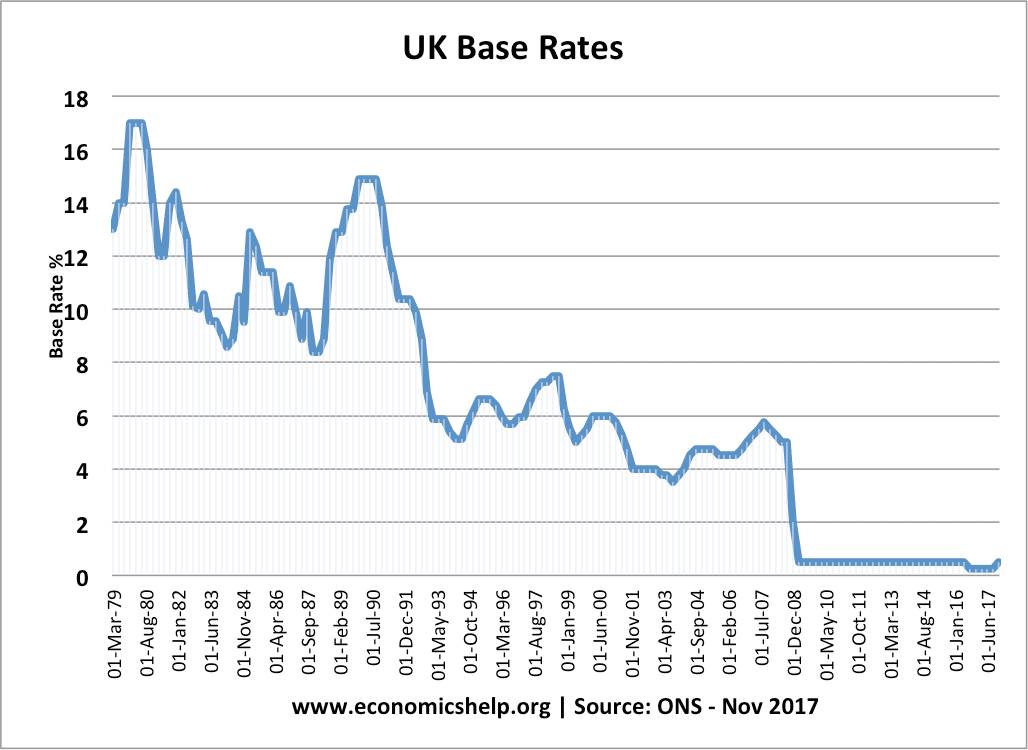

The base rate sometimes known as the bank rate or base interest rate is the most important interest rate in the UK. Monetary Policy Summary and minutes of the Monetary Policy Committee meeting. The spike in inflation has put pressure on the Banks Monetary Policy Committee.

Bank Rate increased to 025 - December 2021. It is used by the Bank of England primarily to control inflation by doing that it can stop prices of everyday things - food fuel clothing - from rising too high. The base rate is the Bank of Englands official borrowing rate.

It strongly influences the UK interest rate which can affect mortgage rates and monthly repayments. Includes the Base Rate increase to 025 in December 2021 and MPC meeting dates for 2021 and 2022. Decisions regarding the level of the interest rate are made by the monetary policy committee MPC.

It is the rate that the Bank of England charges banks and financial institutions for loans with a maturity of 1 day. In. It also helps cap wage growth which can also push inflation too high.

Our Monetary Policy Committee MPC sets Bank Rate. Bank Rate is the single most important interest rate in the UK. Take Control Of Your Money With The HSBC Expat Account.

Banking and savings solutions for life abroad and international lifestyle needs. The Bank of England base rate has risen from 01 to 025 after the majority of the Monetary Policy Committee MPC today voted in favour of raising the rate. Bank of England hikes base rate to 025.

In the news its sometimes called the Bank of England base rate or even just the interest rate. Take Control Of Your Money With The HSBC Expat Account. It is currently 01.

Discover what the current Bank of England base rate is when the next Bank of England MPC meeting is when the interest rate could increase how the base rate can affect your mortgage and how it is affected by Brexit and coronavirus. The Bank of Englands Monetary Policy Committee MPC has voted by a majority of 8-1 to increase the base rate by 015 percentage points. At the end of 2021 the Bank of England voted to increase the base rate to 025 from its record low of 010.

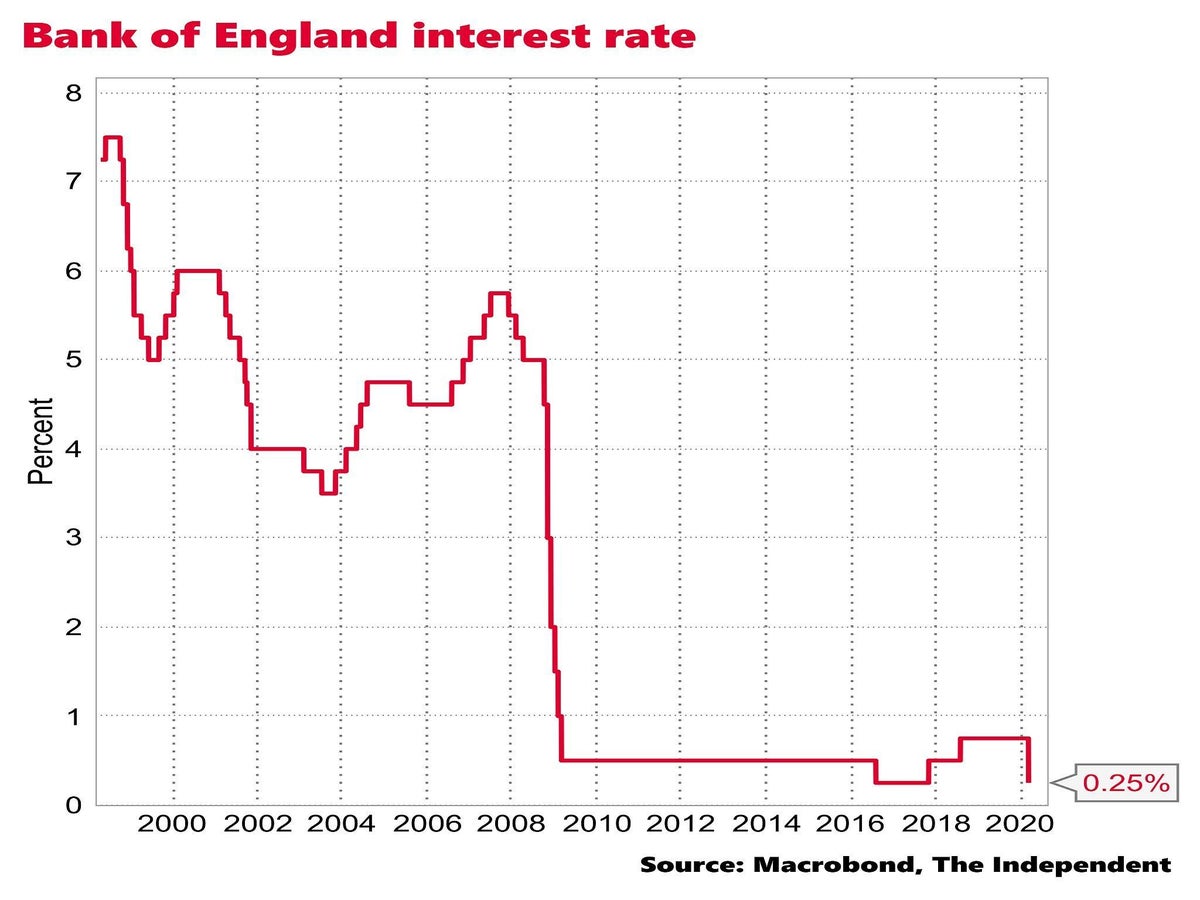

Why Have Interest Rates Been Slashed And What Will The Impact Be The Independent The Independent

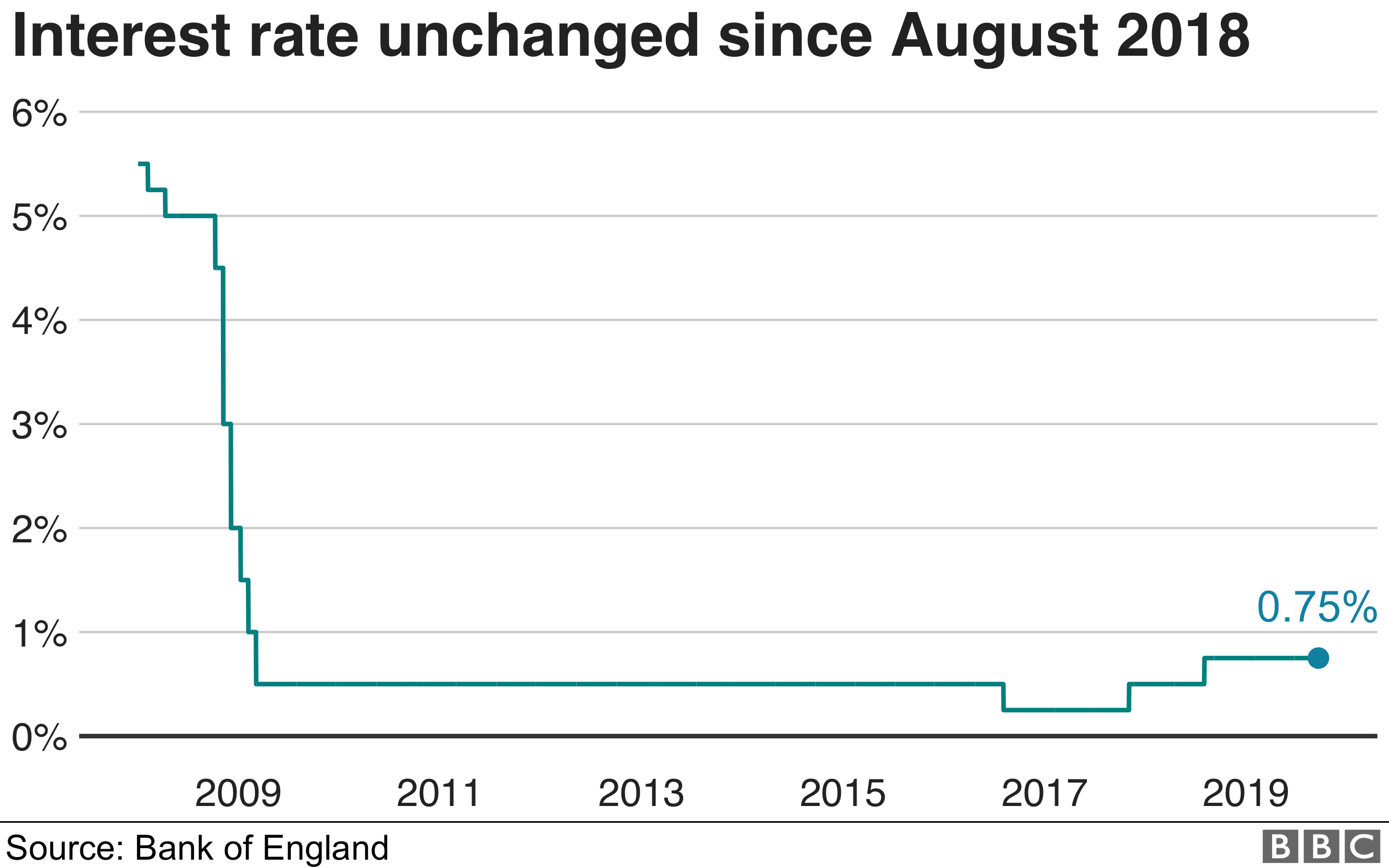

Bank Of England Forecasts Low Interest Rates For Longer Bbc News

Bank Of England Base Rate Money Co Uk

0 Response to "bank of england base rate"

Post a Comment